Plans That Adapt As Life Goes On

Our highly personalized LifePhase180˚ planning approach helps solidify your achievements through all life stages with a focus on establishing your legacy.

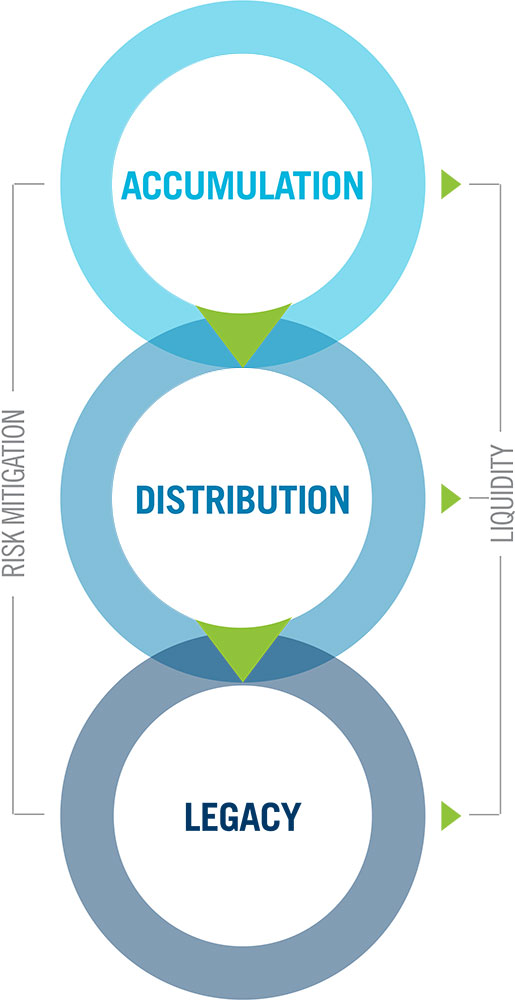

LifePhase180˚ Planning is our comprehensive, custom planning process that evolves as you move through the three key phases of your life: Accumulation, Distribution, and Legacy. Our client relationships begin with a detailed analysis to get a clear understanding of your personal needs and goals. Then, your financial advisor develops a custom investment strategy to help work toward your goals. As your financial needs change, your financial advisor will utilize our mix of resources and services to provide ongoing guidance customized to your specific needs.

For most investors, LifePhase180˚ is a linear progression as life continues. Our goal at Smith Moore is to carefully craft plans which address your changing needs throughout life based on your investment objectives, risk tolerance, and time horizon.

Accumulation

As you begin to build your legacy, it is important to acquire assets to use toward achieving your financial goals. Financial advisors will be a valuable resource at this stage of your journey, as their experience will be your guide.

Distribution

Once you are close to reaching your goal, it is just as crucial to stay disciplined in your planning at this stage as it is in the Accumulation stage. You have worked hard to reach your goal, whether it’s something like retiring comfortably, saving for a child’s college education, or planning a significant charitable gift. You’ll discuss logistics and strategies with your advisor which can be utilized during the Accumulation and Distribution stages to help you achieve what you have worked toward.

Legacy

As you look beyond your life, you likely want to impart some sort of provision for your loved ones or forge a positive difference for future generations. Your financial advisor will work with you to establish where your assets will best suit your end goals, whether you are disseminating them for your loved ones or through gifting initiatives.